- Limited free withdrawals from interest accounts

BlockFi Reviews: Things You Need To Know

Top perks

Earn interest on your holdings

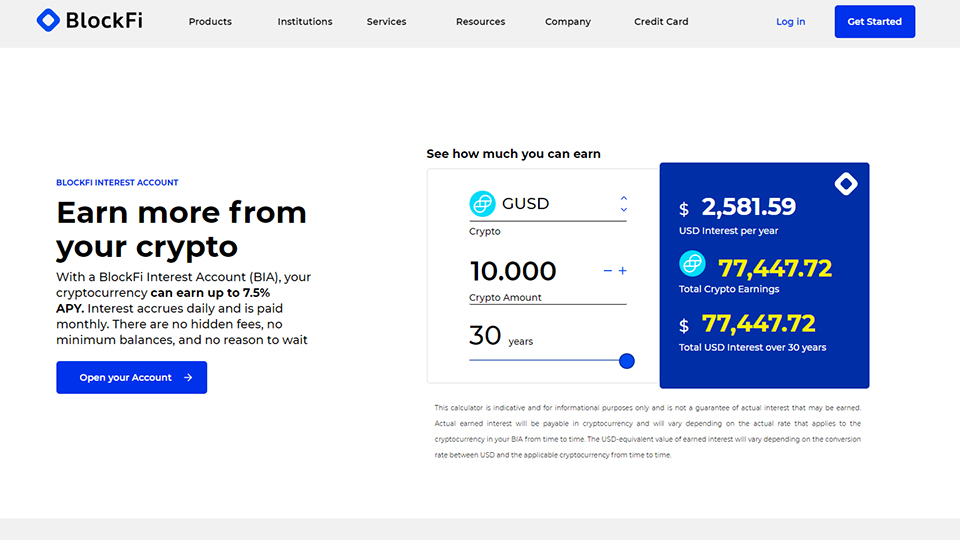

Users can earn 3% to 8.6% compound interest on their crypto holdings with the BlockFi Interest Account. The BlockFi account has the advantage of having no hidden BlockFi Trading Fees and no minimum balance requirement.

The interest rate that BlockFi applies varies by currency and fluctuates with market value. The user will earn interest on his/her interest every month because Interest accumulates daily and is added to the user's account monthly. The Flexible Interest Payment option allows users to choose the currency in which their interest is paid.

Borrow against your portfolio

Users should avoid selling crypto when cash is needed. BlockFi allows users to borrow USD against their crypto assets at very low BlockFi loan rates and BlockFi Interest Rate - around 4.5% at the time of publishing.

Borrowing instead of selling means users don't have to report capital gains and this can save investors money in taxes. In addition, interest can be tax-deductible which offers a huge benefit: reducing the investor's tax bill even further. However, there is a risk to borrowing this way that the investor faces a possible loss of the collateral if the price of the cryptocurrency falls. That means the investor no longer has enough value in the interest account to support his loan balance.

Rewards credit card

As the first company to launch a Bitcoin rewards credit card, BlockFi issues a BlockFi Credit Card that can earn 1.5% bitcoin back on every purchase. Investor's Bitcoin Reward will be added to their BlockFi Interest Account and it will earn interest immediately.

In order to successfully apply for this service, investor applications must be approved for credit, and investors who apply early will have an additional chance to earn even more bitcoins with the card.

BlockFi Investment Advisor Review by TopFreeReviews

The U.S.-based and regulated firm

As one of the few US-based crypto exchanges, BlockFi does not rely on ICOs or utility tokens for funding. Instead, BlockFi pays a steady interest rate by monetizing its lending products. In addition, investors can completely trust BlockFi App because nlockFi's custodian is regulated by the New York State Department of Financial Services.

Automatic trading

Users can set up recurring transactions: automatically buy crypto on a daily, weekly, or monthly basis when they have funds in their BlockFi Interest Account. An investor's account can grow in value and earn interest even if they don't spend a lot of time actively trading that way.

Our verdict

Not only is BlockFi one of the few US-based crypto exchanges, but it also operates under US federal and state regulations. However, funds in a BlockFi account are not insured by the FDIC or SPIC like all crypto assets as we discussed above.

To protect user assets and ensure funds are available, BlockFi employs several security measures. BlockFi holds reserves with third parties, including Gemini, BitGo, and Coinbase. In addition, BlockFi buys SEC-regulated shares and CFTC-regulated futures contracts – i.e. investments regulated by the US government. BlockFi lends carefully with collateral-backed loans up to 50%. What we believe the most is that in addition to being a state-regulated custodian, BlockFi is backed by reputable investors, including Valar Ventures, Morgan Creek Capital Management, Coinbase Ventures, and more.

BlockFi allows users to opt-in to something called whitelists – a self-service security feature that allows investors to ban withdrawals or restrict them to certain addresses helping to prevent theft of their BlockFi account.

To protect long-term investments against inflation, many investors are looking to cryptocurrencies despite the volatility of these currencies because they can be an attractive option to save for the masses. school or other savings plans for children.

BlockFi's failure to offer custodial accounts - which are kept in the names of adults and transferred to children when they turn 18 - is not common among crypto exchanges but the company says it plans to in the future.

Technically, exchanges in most countries, including BlockFi, require users to be 18 years of age or older although there is no legal age to buy or own cryptocurrencies in any country. anywhere in the world. This can create a slight disadvantage: it is difficult for children to take advantage of the potential long-term savings benefits of crypto investments.

BlockFi is suitable for beginner or intermediate crypto investors willing to increase regulation in exchange for greater security. In addition, it also appeals to people who are looking for a personal account or a business account. Of course, BlockFi is the perfect choice for investors who want to earn interest in their crypto holdings. Finally, if users want easy access to portfolio-secured loans to maintain liquidity without incurring capital gains taxes, BlockFi is an option worth considering. We hope BlockFi Review is useful to you!