- Over 650 physical storefronts

- Straight forward quote process

- Online applications are usually approved within an hour

Check Into Cash Payday Loans - Fastest Financial Solution

A Payday Loan (Payday Advance) is a short-term loan commonly used to cover small and unexpected expenses. Borrowers must repay short-term loans by their next payment date, which is usually two to four weeks.

To extend your purchasing power when it matters most, these small value loans are a safe and convenient way. A cash-to-cash same-day loan can help whether borrowers are struggling to make ends meet or are faced with unexpected bills or repairs.

Check Into Cash helps borrowers get the cash they need quickly and easily whether borrowers apply for the Check Into Cash Payday Loan online or visit one of their retail locations nearby, and they are proud to offer Simple loan options. Payday maximum loan amounts typically range from $50 to $1,500 depending on your state and state laws. The Payday loan the borrower receives is, of course, based on the borrower's eligibility and ability to repay.

Remember to choose the right channel before submitting your application, although borrowers can choose to complete their loan online or at one of Check Into Cash's convenience store locations. Of course, users of the Check Into Cash Payday Loan service also do not have to pay extra fees for early payment.

General information

A national leader in short-term credit solutions, Check Into Cash offers everything from no credit check payday loans guaranteed approval to Instant Bill Payment Services. Check Into Cash has not only been a pioneer in the short-term lending industry but has also been providing people with the emergency credit solutions they need for over 25 years. Check Into Cash was founded in 1993 and now it serves customers in more than 650 of their stores and online nationwide specializing in personal credit options.

This company offers a variety of services, including Title Loans, Paper Pawns, Check Payments, Western Union, Payday Advances, Cash Advances, Billing Services, and Cards US money transfers are reloadable at their centers. In addition, Check Into Cash also offers online loan products such as Payday Loan and Installment Loan.

Check Into Cash Payday Loans Reviews by TopFreeReviews.com

Check Into Cash App is growing by following best practices and working with state legislators and federal consumer groups to advance responsible legislation in an effort to balance customer needs with the interests of the industry. Full disclosure of their services and honest advertising helps them build trust and thrive.

Check Into Cash does not charge interest on short-term loans like other short-term lenders. Instead, borrowers pay a flat fee typically around $15 to $30 for every $100 borrowed depending on the state they live in.

In most states, the loans that Check Into Cash near me offers have a term of 14 days. The Annual Percentage (APR) on a Same Day Cash Check loan payable by the borrower can be as high as 400% based on these fees and terms and it can be as high as 1,000% APR in some cases. While not always the case, usually the more a borrower borrows, the lower the interest rate.

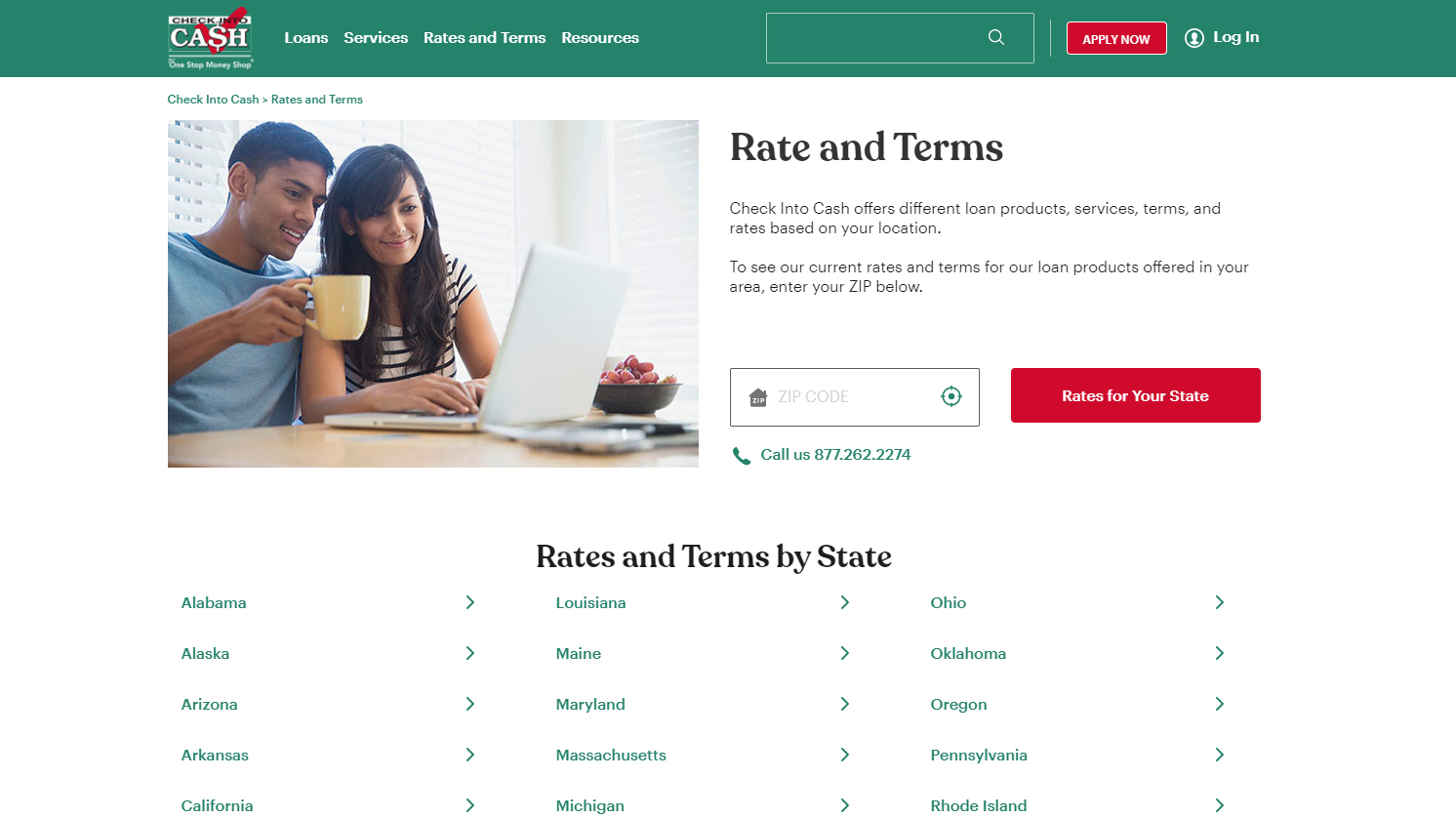

Before signing up, as the effective APR varies from state to state, you should visit the rates and terms page for your state on the Check Into Cash Online website. To make sure the loan fits your budget, you can also confirm the fees charged and calculate the total cost of the loan on this company's website.

One of the most used service

A Payday Loan (Payday Advance) is a short-term loan commonly used to cover small and unexpected expenses. Borrowers must repay short-term loans by their next payment date, which is usually two to four weeks.

To extend your purchasing power when it matters most, these Small Payday Loans Online No Credit Check are a safe and convenient way. A cash-to-cash same-day loan can help whether borrowers are struggling to make ends meet or are faced with unexpected bills or repairs.

Check Into Cash helps borrowers get the cash they need quickly and easily whether borrowers apply for the Check Into Cash Payday Loans online or visit one of their retail locations nearby, and they are proud to offer Simple loan options. Payday maximum loan amounts typically range from $50 to $1,500 depending on your state and state laws. The Payday Loans Online the borrower receives is, of course, based on the borrower's eligibility and ability to repay.

Remember to choose the right channel before submitting your application, although borrowers can choose to complete their loan online or at one of Check Into Cash's convenience store locations. Of course, users of the Check Into Cash Payday Loans behavior also do not have to pay extra fees for early payment.

Our verdict

Check Into Cash Payday Loans can provide borrowers with quick access to cash, but they often come with extremely high payout rates. Since they can quickly lead to debt and other financial problems, even the best payday loans should only be considered a last resort. Our advice is to always consider alternatives before taking out a Payday Loans Bad Credit if you're in debt. However, if no credit check payday loans guaranteed approval is a suitable option for your financial situation, you should choose relatively well-known brands with a large number of physical storefronts like Check Into Cash to guarantee your payment. your own safety. Check Into Cash's rates are quite in line with industry averages and funds can be made instantly to customers applying for a direct short-term loan. Check Into Cash is as reputable as any big name in the industry, and they also state their commitment to best practices and ethical behavior.