- Coverage for damaged

- Priority customer support

- Identity theft protection

- Cell phone protection

- Purchase protection

Greenlight Investment Advisors - Financial solutions for children

One of the most important skills parents can develop with their children is financial literacy. Understanding money can help kids become confident, move forward in life, and achieve their goals.

The Greenlight debit card is one of the tools available to help your child learn more about money. We took a look at the information and features of the Greenlight kids card and see if it's right for your family.

How Greenlight works

Founded in 2014 by co-founders Tim Sheehan and Johnson Cook, Greenlight is a fintech company that currently serves over 3 million users and is headquartered in Atlanta, Georgia.

Through the website, we learned that Greenlight claims to help families raise financially smart kids by providing a debit card that parents can use to pay allowances and track expenses. pepper. Moreover, Greenlight Technology also gives the kids investment opportunities. Children not only have the opportunity to learn about how to spend and save with Greenlight Debit Cards but also learn the basics of investing thanks to other services provided by Greenlight.

The Greenlight Debit Card is designed for use by children. Parents can top up their debit card using the Greenlight app and then their kids will have access to the money. The option to make a transfer can be done manually or set up an automatic weekly transfer. In addition, parents can also set terms to add money to encourage children such as asking for chores, getting good grades, or just providing an allowance and adding money to the card for emergency purposes.

Both parents and children will see different information when they log in even though they both have access to the Greenlight Investment app. Parents can see what's going on with their child's account to track balances, view purchases, approve each transaction if they want to invest. Meanwhile, the kids can see their balances, set goals, and learn valuable lessons by logging into the app. Helping your kids learn about financial management with a set of tools in a mobile app is the main aim of this company.

You can have complete peace of mind about your Greenlight Savings and Spending Balance because it is insured by the Federal Deposit Insurance Corporation (FDIC) up to a $250,000 limit. On the investment side, we have read on the official website of the company that Greenlight is registered with the US Securities and Exchange Commission (SEC) and is also a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC). So while investment risks are obvious and there are no guarantees for the decisions users and their children make about money, they can rest assured that they will remain protected in case the Greenlight Investment company fails.

Greenlight Investment Advisor Reviews by TopFreeReviews

Greenlight plans

Greenlight

This basic plan from Greenlight costs $4.99 per month at the time of publishing and includes Greenlight debit cards that users can get for up to five children. Users are given access to the Greenlight Investment app, which provides two different experiences for parents and children. Greenlight Investment Advisors includes tools that allow kids to view their spending balance, save, set their own goals, track items like allowances, and other ways of making money. Parental controls including choosing to add money to their child's Greenlight Debit Cards, as well as setting spending limits, store-level controls, and monitoring what's going on in their child's account are also included in the Greenlight Account.

We think the Greenlight Basic Plan is a useful tool to help kids learn about money management and setting savings goals and is the least expensive option that is likely to work well for families with young children. New to money management. This plan can be suitable if the user is interested in helping their child develop financial literacy.

Greenlight + Invest

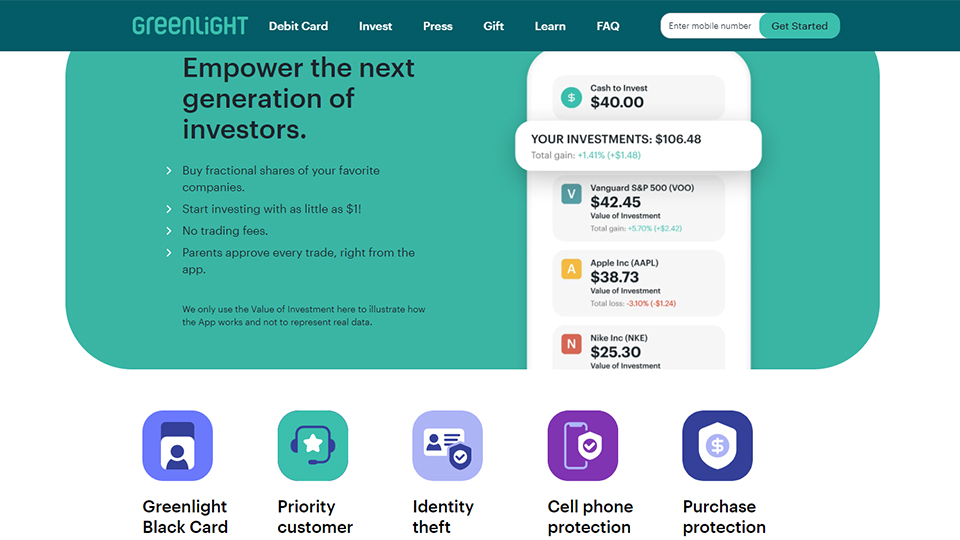

Greenlight + Invest added an investment element by the founder in addition to all the tools available in the Greenlight plan. For as little as $1, your kids can start learning how to invest money with no transaction fees on a platform designed for them. These transactions require approval from the parent account.

Greenlight + Invest can be a way to help children learn about investing and the importance of getting started for those who want their children to be aware of the value of money and ways to increase their wealth. With the help of Greenlight + Invest, kids can buy fractional shares and invest in the companies they love. Greenlight + Invest could be a good plan for your family at $7.98 per month at the time of publishing if your kids are old enough to learn about investments and start making those choices.

Greenlight Max

Greenlight Max also comes with added benefits beyond having a Greenlight kids debit card, access to investing, and other financial management learning resources. First, users will get priority support for their problems. Additionally, other included benefits that the company offers include Identity Theft Protection. This feature helps with identity monitoring and alerts to help keep up to date with identity-related threats. The Cell Phone Protection function can protect up to five children if the mobile phone purchased with Greenlight is damaged or lost. Furthermore, your damaged or stolen items that were paid for with Greenlight can be replaced or repaired using Purchase Protection. We think this package will be suitable for families who want comprehensive protection alongside access to financial resources and tools for $9.98 per month at the time of publishing.

Our verdict

Greenlight Investment Advisors can be a useful tool thanks to several resources and users can easily see what their children are doing with their money at any given time.

While there are other ways we can give our children access to a regular or prepaid debit card, and learn about investing with no fees, I'm sure that Your money has a reason for it. Many of the best banks offer us joint accounts with children and these give parental access and control but things are perhaps not as simple as what we get with Greenlight Technology. So if you want everything in one place and in a way that's easy to see and manage then we think Greenlight Investment Advisors could be worth it. We hope Greenlight Investment Advisors Reviews were useful to you!