- Deferred taxes or no taxes

- No more waiting for custodian approval

- No preset menu of investments

- No asset or transaction fees

Rocket Dollar Review: Invest With The Least Amount Of Effort

Rocket Dollar - top prestige

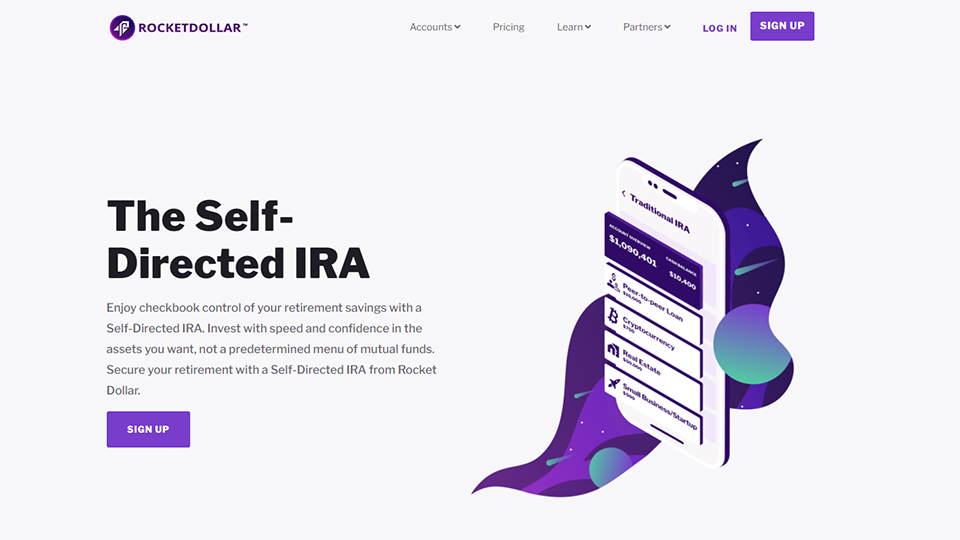

Founded in 2018, Rocket Dollar is famous by offer investors an easier way to hold assets in retirement that traditional brokerage accounts can't. This unique financial institution allows users to create an IRA or Solo 401(k) that works with nearly any asset they can imagine.

Rocket Dollar Ira sets up a user's investment account like a company when a user opens a new account. In effect, Rocket Dollar Self Directed Ira will open a limited liability company (LLC) that will allow a user's IRA to run its own "business" on behalf of the user in some states. This is by far the easiest and simplest way I have come across although there are a number of current options for investing in real estate or other assets with a retirement account.

Once an investor's account is active, they can invest in almost anything and it's easier to list the things we can't invest in because it's a much smaller list than the things we can't invest in we are allowed to buy.

Self-Directed IRA - Awesome tool

What makes self-directed IRAs different when most of us are familiar with Traditional IRAs (Individual Retirement Accounts)—tax-deferred savings accounts with no income limits? We want to emphasize that the only difference with a few exceptions is what investors can invest in.

Self-directed IRAs are broader and do not have the same restrictions while Traditional and Roth IRAs do not allow such investments. They are not a recent phenomenon although they are still less common.

To save for retirement in a tax-deferred account and diversify assets, investors can use a self-directed IRA to invest in non-traditional assets like startups, real estate, precious metals, cryptocurrencies, commodities, and private positions. All assets in the account are managed by a trustee or custodian whether it is investments in a new business or a new real estate transaction.

Rocket Dollar Investment Advisor Review by TopFreeReview

The types of assets investors can hold are the only difference between a traditional or Roth IRA and a self-directed IRA. Investors should be aware that traditional and Roth IRAs have tighter restrictions and require investors to stick with stocks, bonds, mutual funds, and exchange-traded funds (ETFs), which makes high net worth individuals are less selective. Statistically, however, millions of people still choose a traditional IRA to continue their retirement investment strategy that started with a 401(k) corporation.

This can be a worthwhile strategy for building a good retirement savings asset base for many investors. Using a self-directed IRA can be a great strategy to supplement existing investments once your assets have grown to the point of being able to diversify beyond the traditional options offered by institutional investors major financial institutions such as Fidelity, Charles Schwab, or Vanguard.

Note when starting

Remember that the IRS prohibits IRAs from investing in life insurance, collectibles, S-Corp stocks, alcoholic beverages, gems, carpets, most coins, and metals that fall outside of the four categories. specifically approved (gold, silver, palladium, and platinum). The investor's limit is the limit, as long as it is an investment and not for personal use. There may be additional exclusions for some small business owners.

The website Rocket Dollar Ira concluded after their reports that some of the popular investments include private equity, real estate, precious metals, peer-to-peer lending, and cryptocurrencies. Just write a check from your LLC bank account and you're good to go if you're interested in angel investing or venture capital with your retirement.

Other common investments this company records include business investments (non-S-Corp), Rocket Dollar Bitcoin, business loans, undeveloped land, crops, livestock, certificates of deposit (CDs). and wood vouchers. We hope Rocket Dollar Review is useful to you!