- Manage all your cards

- Automated payments

- Customized payoff plan

- Available on iOS and Android devices

- One easy monthly payment

- Free to download

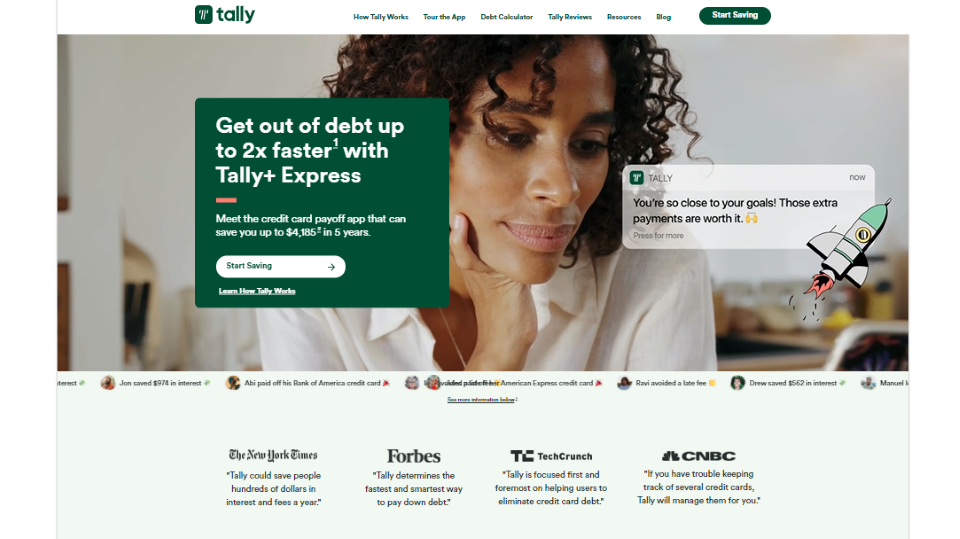

Tally - Optimizing your financial situation

How Tally works

Founded in 2015, Tally Technologies is a financial services company known for helping qualified users pay off credit card debt. This California-based company offers customers an app with tools like a dashboard to view all their credit card information in one location and a debt manager to customize their payment plans. existing credit card debt. You need a credit score of at least 660 to be able to use Tally's line of credit to receive lower interest rates on the debt you hold. Late fee protection is also offered to customers by Tally.

As a credit card consolidation smartphone app, Tally Loan helps users view all their credit card balances to get a complete view of their overall debt on one dashboard. Users can also apply for a dedicated line of credit to pay for higher APR credit cards already registered on the Tally app because it also customizes the debt management plan. For example, users cannot use a Tally credit line to make purchases or finance home improvements.

After analyzing the borrower's credit card records, Tally provides the application with a credit line. A loan with a lower APR than you are currently paying on your credit card will be offered to you by Tally. You need to remember that the tally credit line is only used to pay off existing credit card balances. Tally will roll over the higher APR balance to the line of credit once the borrower is approved, then make payments on the existing balances. Users will eventually make one monthly payment to Tally instead of paying each credit card bill individually.

Users can download the Tally app for free. Tally pays card issuers directly while credit card balances with higher APRs are carried over to Tally's credit line. The company will make the minimum payment on the card's balance until the lower rate expires if some cards have an APR below the Tally Credit Card credit limit. This allows users to take advantage of promotional interest rates.

Tally Reviews By TopFreeReviews

Things you need to know

Keep in mind that Tally Loan will charge interest on the amount the user borrows within the line of credit to pay off those higher APR credit card balances. However, users will not have to pay an annual fee or fee for the initiation, prepayment, or balance transfer. No late fees on cards that pay from your Tally credit line are something Tally guarantees.

Users can choose the You Pay or Tally Pays feature from the Tally app. The company will pay the card each month by credit line if the user chooses Tally Pays. The user receives an invoice and reimburses Tally. The user is responsible for paying the card issuer if they designate a You Pay card.

The company will transfer the higher APR credit card balance to the loan if the user is approved for the Tally credit line. Monthly statements will be automatically paid by Tally using the user's credit line, which is sent to the Tally account the user has set up on his app.

Users must qualify and accept the Tally Credit Card to receive the benefits of the Tally line of credit. The APR - like the user's interest rate - will range from 7.90% - 29.99% per year at the time of publishing based on the user's credit history. You need to double-check as the APR can vary by market based on the Base Rate.

Advantages that make you choose Tally

Statistically, we know that 50% of Tally + Express members can get out of debt around 3 years, or 41%, faster with Tally + Express. It reflects the potential time to repay a significant number (at least 10%) of Tally + Express credit line users. This company has done reliable reports comparing the time it takes users to pay off their credit card debt if they have received and accepted Tally + Express lines of credit and compares it to how long it would take for users to pay off their debt. their credit card without Tally Loan. For each borrower, Tally used the borrower's average APR calculated based on the borrower's initial credit card balance and borrower's APR, an average monthly payment of 3% on their individual credit card balances. borrowers and average monthly credit card transactions are 0.8% of the borrower's credit card balance. Tally assumes that the borrower receives a monthly Tally + Express discount credit. It's easy to see that the actual payment rate will vary based on factors like the APR on each user's credit card, the total number of payments made, and additional credit card charges. use.

There are no upfront costs because the Tally + Express annual fee is prepaid from the user's credit line. A user's credit score is not affected by the credit checks that Tally performs to determine a user's eligibility. In fact, Tally Loan has actually helped many people improve their overall credit scores. If a user chooses to activate his or her credit line, Tally can report that line of credit to the credit bureaus. A user's Tally account will be classified as a line of credit rather than a heavily used credit card once reported. Tally's team must report the amount due in the past and its severity to the credit bureaus if a user's Tally account becomes delinquent.

Users can choose a Tally + Express membership for a higher discount and a larger credit limit. Users will receive discounted credits applied to their Tally principal balance each month with Express. User effective APR will be reduced by an average of 4% after 12 consecutive credit months. Members need to pay at least on time to maintain the Express discount.

Tally + Express will give members access to a larger credit line and a discount program that effectively reduces users' APRs and maximizes users' interest savings. Users will always be able to see their effective APR after Tally's discount, right on the "Account" tab after being a member of this company. Hope Tally Review is useful to you!