- Weekly stock recommendations with expert analysis

- Relatively affordable annual cost compared to some investment newsletters

- Text and email alerts give you quick information

- Community and investing resources

- Recommendations can move the market

The Motley Fool - The Leading Prestigious Company In The Field Of Financial Investment

The story of The Motley Fool

History begins

The founders of The Motley Fool believe that investing is empowering, enriching, and enjoyable and they look forward to joining each client on their journey to financial independence. A spokesperson for The Motley Fool says they take their purpose seriously, but that doesn't mean they take themselves too seriously. While other companies can make customers smarter, happier, or wealthier, The Motley Fool Stock aims to do all three by providing excellent business and investment advice - with the right decision.

The name of The Motley Fool is in homage to a character in Shakespeare literature - the court jester - who was able, to tell the truth to the king and queen without their heads. The story also reminds us of The Fools of yore entertaining the courts with humor that kept them entertained and, more importantly, The Motley Fool always appreciating those who were never afraid to question their wisdom usual good.

The action comes from the heart

The Motley Fool believes in treating every dollar as an investment in the future customers wants to create. The Motley Fool believes that investing in great businesses over the long term is the most effective route to wealth. The Motley Fool Stock also emphasizes the belief in the power of a community to learn and grow together. Each client can consult information to trust The Motley Fool's score maintenance and transparency. In addition, this company also strives to fulfill its purpose by truly serving every Fool, from its employees to its members, to its community.

The Motley Fool App offers a variety of solutions to improve many areas of a client's financial life, including portfolios, personal finance, real estate ownership, corporate and client career row. The Motley Fool is headquartered in Alexandria, Va., with offices in Denver and Sydney, Australia. Therefore, it is very convenient to serve investors and businesses in the UK, Australia, Canada, and Germany.

The Motley Fool's culture is about making the world smarter, happier, and richer at work. They believe that people should have the freedom to follow their passions every day in roles they love. The Motley Fool works hard to understand the needs of its employees and provide for them. The Motley Fool is confident that this will make for a great business: take care of your employees and they will take care of your customers, who will take care of the shareholders. The Motley Fool Stock thinks every company should do the same. We appreciate The Motley Fool's working style and culture, so we decided to choose this company to analyze the aspects in which they can help clients in financial investment on our The Motley Fool Review.

Motley Fool Stock Advisor Review by TopFreeReviews

The best services

Stock Advisor

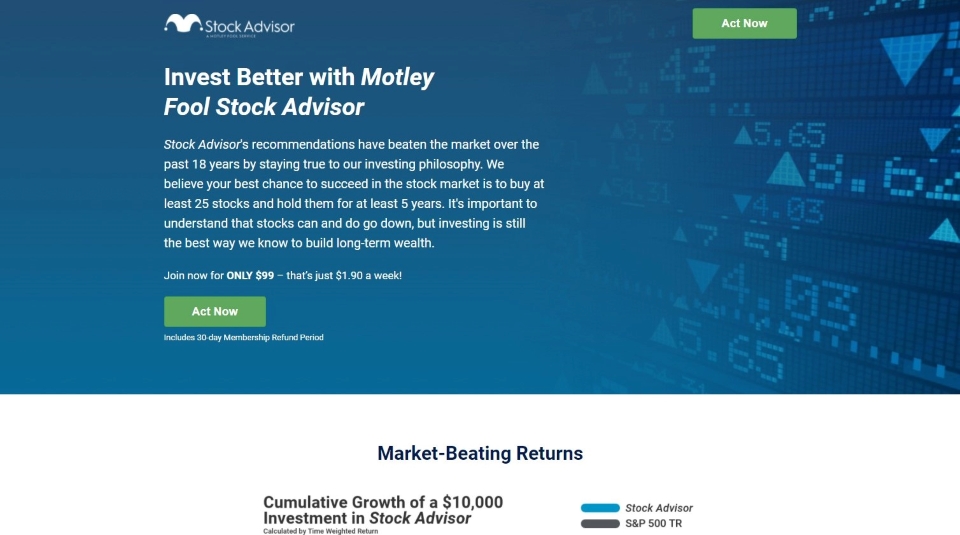

Stock Advisor offers clients two new stock picks per month, and their latest stock recommendations are sent to clients monthly. This ensures that the client does not miss any potential business items and is regularly updated on the value of the latest stocks. Additionally, The Motley Fool Stock offers 10 timely purchases selected from over 300 stocks.

If you are a beginner to learn about financial investments, you do not need to worry too much about whether the money you have saved for a long time is in danger because The Motley Fool updates its stock recommendations platform votes for new investors in addition to experienced investors. All users get access to The Motley Fool Investment Guide, educational materials, and the world's greatest investor community to help them invest more effectively. To enjoy all the perks we just mentioned, customers only need to pay $199/year at the time of publishing.

This bundle has a Return of 600%, and an S&P of 135%, and is calculated using the average return of all stock recommendations since service started.

Rule Breakers

Rule Breakers also offers customers the same perks as Stock Advisor but at a slightly higher price point - $299/year at the time of publishing. Of course, the stats we get will also be more impressive: 335% (RETURN) and 117% (S&P) - calculated by the average return of all stock recommendations since the inception of the service.

Stock Advisor and Rule Breakers Bundle

The Stock Advisor and Rule Breakers Bundle is a combination of these two powerful services to help customers maximize investment efficiency at an affordable price of $498/year at the time of publishing. Customers not only double their new monthly offers with this plan, but they also unlock instant access to breakout stocks that the company believes have the potential to "maximize" instantly. Plus you'll receive a list of 15 "Best Buy Now" stocks each month - stocks selected from both Stock Advisors and Rule Breakers.

Final Thoughts on The Motley Fool

If you read all the news and investor education content, many investors will even admit that some of their investments won't go as planned. They make no secret that they are losers even though there are times when they proudly boast of being winners. We will not analyze The Motley Fool's portfolio exactly, but we do affirm that the company's recommendations are a good data point in formulating a client's investment strategy for its shareholder’s individual votes.

Some people may question in their heads whether the Motley Fool is a pump and dump scheme? Pumping and dumping are when an individual or entity attempts to increase the price of a stock based on false, misleading, and often exaggerated claims to attract investors.

We think the Motley Fool is not a pump and dump scheme because they look like a respected investor newsletter and they provide links to their research. The Motley Fool App's large subscriber base can affect the stock price shortly after its announcement, leading to some opportunities for market manipulation but The Motley Fool essentially works in its own right up.

We think that most investors should not put their entire portfolio on the recommendations of any stock picking service - The Motley Fool stocks to buy and that clients should learn how to invest in stocks. However, among the companies we surveyed and compared, The Motley Fool's service has a good reputation and a strong track record of success.

In our opinion, the stocks in the portfolio offered by this company are reasonable. Sure, there's never any guarantee of future performance for your money, but advisors tend to do well overall. We hope The Motley Fool Stock Advisor Review has been helpful to you!