- Offers personal portfolios with a hedge-fund-like strategy

- Low account minimum

- Personal digital vaults

- Ability to pay 0% fees

- No access to financial advisors

Titan Investment Reviews - Investing Is Easier And More Comfortable

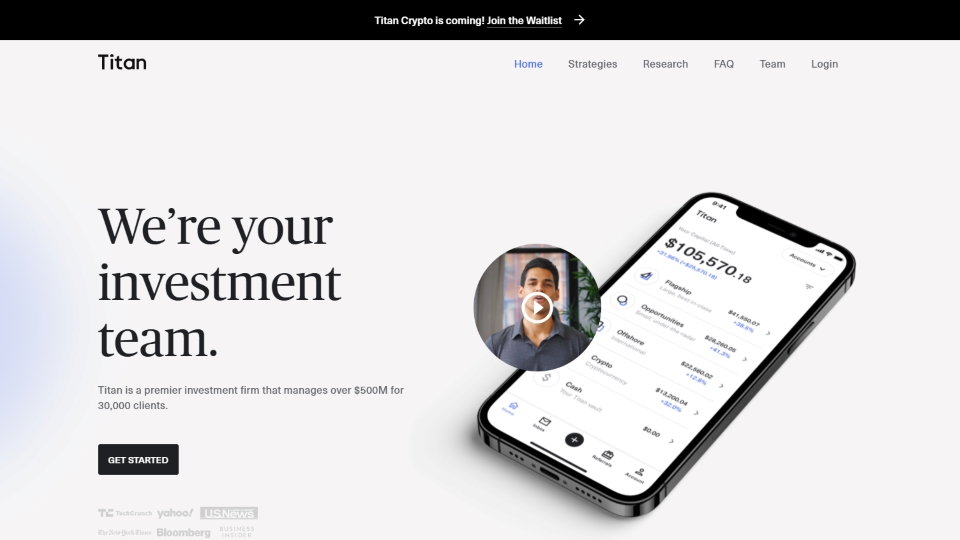

What is Titan?

Titan provides investors with no-frills investment options in portfolios containing many stocks. The goal of this business is to offer all investors the type of investment management usually only offered to the wealthy with actively managed stock portfolios. Titan's fees are lower than those of hedge funds and similar services - only 1%. However, some investors who want tax strategy, access to financial advisors, or other features may find Titan suboptimal.

Founded in 2018 by former hedge fund managers, Titan Investment wants to create a world-class investment management system for everyone. One of the main reasons for this was that founders were frustrated by the divide between the investment and outreach advice their wealthy clients received and the advice given to friends and family. To do this, Titan has offered two investment strategies with minimums starting at just $100.

How Titan works

Titan Invest builds and manages your portfolio like many conventional robot advisors. However, what makes Titan Investment different beyond the personalization hedge is its investment in individual stocks rather than a traditional ETF, which is a basket of different securities.

The individual stocks of the 20 highest quality companies in the market that Titan Company trusts such as Microsoft, Alphabet (Google), Apple, etc. are the limit Titan put your money. These are all well-known enterprises in the market and have grown steadily over the years, making them a safe choice for many investors, including senior investors. Your portfolio will then be provided with an automatic “personalization hedge” by Titan International Stock once individual stocks are selected. It is worth mentioning that the size of the hedging will depend on the investor's individual risk tolerance assessed when opening the account.

Titan Investment Advisor Reviews by TopFreeReviews

The range that Titan offers is: conservative, moderate, and belligerent. The less risky you are, the greater the hedge against your individual stock investment. This allows investors to avoid severe price fluctuations and overall market volatility, but it will not guarantee the protection of an investor's primary investment and their overall portfolio. You can still lose money.

To better understand how investors' funds are allocated based on their risk appetite, we will refer to the general Titan rule in the event that an investor's portfolio is not degraded. For the prudent investor, Titan will allocate about 10% of their positions to short. The number will be 5% for Moderate Investor and 0% for Active Investor. The breakdown's numbers will change if an investor's portfolio is in recession, by 20%, 10%, and 5%, respectively. Of course, the numbers we give are for reference only at the time of publishing, and remember that the Personalized Hedge feature is completely automatic. We also want to emphasize that the Personalized Hedge's self-adjustment will depend on the investor's portfolio performance relative to the S&P 500. Much of an investor's funds will be allocated to the hedge if the investor's performance of their portfolio starts to fall against the S&P 500 over a period of time and vice versa.

Specialty of Titan

A concept that any investor should know is a Hedge Fund - a group of money contributed by investors with a fund manager whose mission is to maximize returns for investors while reducing profits. Risk mitigation through “hedging”.

We may not realize it sometimes, but we have created financial “fences” in our lives when we own a home and have purchased homeowners insurance for that home. protection from fire and break-ins. And so, we're basically buying hedges.

The basic principle still applies, although hedging with stocks is a bit more complicated than simply ensuring stocks. An investor will invest in an asset, a stock, and then buy another financial instrument to pay off in the event that the asset depreciates. It's worth mentioning that hedge funds can invest in pretty much anything - stocks, real estate, land, currencies, and more. and highly responsive to the market.

Titan Invest replicates the strategies used by hedge funds to outperform the market returns over the long term even though it is not a hedge fund because it provides clients with a hedge. personalization to protect capital in times of market downturns and high volatility. We find that the Titan Invest account is highly responsive to the market just like hedge funds. When a stock or an investor's overall portfolio enters a downturn, Titan Company recalibrates its Flagship stock portfolio each quarter.

Liquidity is a key difference between a Titan account and a hedge fund account. Investors can withdraw their money whenever they want when investing with Titan while hedge funds lock investors' funds to allow managers to back out of investments.

Finally, what we appreciate about Titan is that its costs to investors are much lower than the average hedge fund. Hope Titan Review is useful to you!